Highlights of My Professional Story

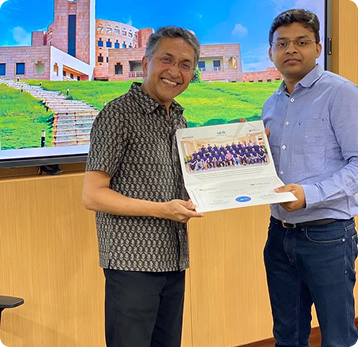

Award by PNB MetLife CEO

Honored with the prestigious Make a Difference award by the CEO of PNB MetLife for exceptional contributions that significantly impacted business performance and team outcomes. This recognition stands as a testament to leadership, dedication, and the ability to drive meaningful change.

Top Scorer in CA2 Actuarial Exam

Consistently ranked among the highest scorers in the CA2 (Model Documentation, Analysis and Reporting) actuarial exam, showcasing advanced analytical abilities, precision in model communication, and excellence in actuarial reporting standards.

Cleared 9 Actuarial Exams in 1.5 Years

Demonstrated an accelerated learning curve and deep understanding of actuarial science by clearing 9 professional actuarial exams in just 18 months — a feat that reflects commitment, discipline, and intellectual agility in a highly rigorous field.